rugway-ie.ru

Learn

Do Credit Cards Have Travel Insurance

No, not all credit cards offer travel insurance. The easiest way to tell if your card does is to call the customer service phone number on the back of your the. Your American Express Card may include complimentary domestic and international Travel Insurance, as well as retail insurances like Card Refund and Purchase. When traveling abroad: Your insurance will start automatically if, before the start of the trip, you: Paid for round-trip tickets with a premium Visa card. No. I typically do not require top up insurance on my credit card. You just might want to watch how much cancellation insurance it covers up to. Insurance coverage(s) included with CIBC credit cards are provided by Royal & Sun Alliance Insurance Company of Canada (RSA). Different cards will have. The fact is that the majority of credit cards do not provide any travel insurance coverage. Make an instant purchase online and get instant visa letter. Learn. Many credit cards offer travel insurance for things like canceled or interrupted trips, lost or delayed baggage or car rentals. If you pay for your trip with a. Why Do Credit Cards Offer Travel Insurance? You'll notice that many cards' insurance policies place an emphasis on travel. That's because premium credit cards. Holders of Visa Platinum, Visa Signature, Visa Infinite, Visa Platinum Business and Visa Signature Business premium cards will be automatically insured when. No, not all credit cards offer travel insurance. The easiest way to tell if your card does is to call the customer service phone number on the back of your the. Your American Express Card may include complimentary domestic and international Travel Insurance, as well as retail insurances like Card Refund and Purchase. When traveling abroad: Your insurance will start automatically if, before the start of the trip, you: Paid for round-trip tickets with a premium Visa card. No. I typically do not require top up insurance on my credit card. You just might want to watch how much cancellation insurance it covers up to. Insurance coverage(s) included with CIBC credit cards are provided by Royal & Sun Alliance Insurance Company of Canada (RSA). Different cards will have. The fact is that the majority of credit cards do not provide any travel insurance coverage. Make an instant purchase online and get instant visa letter. Learn. Many credit cards offer travel insurance for things like canceled or interrupted trips, lost or delayed baggage or car rentals. If you pay for your trip with a. Why Do Credit Cards Offer Travel Insurance? You'll notice that many cards' insurance policies place an emphasis on travel. That's because premium credit cards. Holders of Visa Platinum, Visa Signature, Visa Infinite, Visa Platinum Business and Visa Signature Business premium cards will be automatically insured when.

Amex Travel Insurance provides Multi-Trip Annual Plans that are a convenient and cost-effective way to get travel insurance coverage when you travel more than. Many credit cards come equipped with some form of travel insurance, ranging from trip and flight coverage to car rental insurance. However, it's important to. Some credit cards come with one or more type of insurance embedded in the card. Examples of these insurances include car rental insurance, trip cancellation. This benefit is available on all Visa credit cards. Who do I contact for help? If You need to replace Your card or want help with receiving emergency cash. It typically includes benefits like trip cancellation or interruption insurance. Some cards cover baggage loss, theft or delay, and emergency medical expenses. Some credit cards provide auto rental coverage, as well as travel and emergency assistance. You'll want to understand the specific terms to find out what you're. This coverage does not include Commutation. Commutation is defined as travel between the Insured Person's residence and regular place of employment. Common. 25% of consumer cards offer travel accident insurance, providing an average of $, in coverage. · 29% of consumer cards offer trip cancellation insurance. You have coverage for up to $ per insured person for your trip. Delayed and Lost Baggage Insurance. If your baggage is lost or delayed, each insured person. Pre-existing conditions are typically not covered by credit card travel insurance. Even if you have a limited amount of cover for a pre-existing medical. Many credit cards come equipped with some form of travel insurance, ranging from trip and flight coverage to car rental insurance. However, it's important to. The fact is that the majority of credit cards do not provide any travel insurance coverage. Make an instant purchase online and get instant visa letter. Learn. But credit card providers do not offer full travel insurance, as they do not pay out for medical issues that may arise during a trip overseas. They will. No, not all credit cards offer travel insurance. The easiest way to tell if your card does is to call the customer service phone number on the back of your the. Many credit cards and group coverage insurance plans come with the additional perk of automatic travel insurance at no additional cost. Some credit cards offer basic travel insurance benefits. They offer coverage for the unpredictable situations a cardholder may find themselves in. As compared. Most credit card travel insurance plans are underwritten by a traditional travel insurance company, and contain a lot of the same conditions. This benefit is available on all Visa credit cards. Who do I contact for help? If You need to replace Your card or want help with receiving emergency cash. coverage for the trip they have to make to come to your bedside, up to If you have more than one credit card with Accident coverage or if you have. Which Credit Cards Offer Comprehensive Travel Insurance Options? · Chase Sapphire Card (Chase Benefits) · United Explorer Visa Platinum Card (Explorer Card.

Farmers Marine Insurance

State Farm inland marine insurance protects your movable or transportable property. Learn more and contact an agent today! Personal inland marine insurance (also called scheduled personal property) can provide coverage © Redwood County Farmers Mutual Insurance Company. All. Learn about specialized boat and personal watercraft insurance and get a quote from Foremost - A Farmers Insurance Company. Marine Insurance Policy from Midwest Preferred Mutual Insurance, the best Independent. Farm Coverage. Learn More. Had hail damage a few years back, Farmers. Links to marine insurance companies offering boat and yacht insurance at competitive rates. Boat Insurance by Farmers Insurance. Boat & Personal Watercraft. Which? Insurance Brand of the Year NFU Mutual offer personal service with over UK Agencies to insure your home, farm or business and plan your. For boats larger than 21 feet or more expensive than $20,*, a Marine Policy is required. Separate from your Homeowners Policy, a Marine Policy offers more. Coverage for Pleasure Boats And More · Liability Coverage. If you're legally liable in a boating accident, boat liability coverage can help pay for injuries and. Protect your food vendor business at farmers markets with FLIP's farmers market insurance. Purchase your policy online today starting at $/month. State Farm inland marine insurance protects your movable or transportable property. Learn more and contact an agent today! Personal inland marine insurance (also called scheduled personal property) can provide coverage © Redwood County Farmers Mutual Insurance Company. All. Learn about specialized boat and personal watercraft insurance and get a quote from Foremost - A Farmers Insurance Company. Marine Insurance Policy from Midwest Preferred Mutual Insurance, the best Independent. Farm Coverage. Learn More. Had hail damage a few years back, Farmers. Links to marine insurance companies offering boat and yacht insurance at competitive rates. Boat Insurance by Farmers Insurance. Boat & Personal Watercraft. Which? Insurance Brand of the Year NFU Mutual offer personal service with over UK Agencies to insure your home, farm or business and plan your. For boats larger than 21 feet or more expensive than $20,*, a Marine Policy is required. Separate from your Homeowners Policy, a Marine Policy offers more. Coverage for Pleasure Boats And More · Liability Coverage. If you're legally liable in a boating accident, boat liability coverage can help pay for injuries and. Protect your food vendor business at farmers markets with FLIP's farmers market insurance. Purchase your policy online today starting at $/month.

Antigonish Farmers' Mutual Insurance Company - A Company to Call Your Own. Antigonish insurance providers for over years. FMG's Boat policy covers you at sea and on dry land. Your boat What are you interested in? Farmers and Growers' insurance; Lifestyle block insurance. Marine Insurance Claim Study, collisions with other boats or Read More · Things Your Home Policy Does Not Cover and What to Do. By Farmers Union | June Commonly, a farm insurance policy will include coverage for business interruption, helping offset lost income and essential expenses during temporary farm. As a Farmers Insurance company, Foremost offers coverage with the same great strength as its name-brand parent company. Foremost's boat insurance serves a. Insurance - Commercial, Life, Disability, Boat, Auto & Home, Financial Services, IRA, Education Funding and Annuities. Highlights. Local Agent - Living, Working. What kind of insurance do farmers and ranchers need? The exact coverage marine insurance. What is farm and ranch liability coverage? Farm liability. Inland Marine. Don't overlook the coverage of your specialty items such as jewelry, cameras, bicycles and more. Call us to learn. OUR HOME PROTECTION POLICY OUR FARM PROTECTION POLICY INLAND MARINE POLICY · WHO WE ARE · CONTACT · Login. () Farm Protection Plan. GIVING FARMERS. For a business that's on the move, inland marine protects your property while off-site or in transit. Learn more · Commercial Auto. Commercial Auto. Whether or. Direct physical loss of or damage to the described property (the boat) is covered under Farmers Mutual's Inland Marine Policy. Do I need additional liability. Boat, Jet Ski, and yacht coverage with State Farm helps protect against any risks that come with owning a boat. With 24/7 customer service. Inland Marine Insurance Coverages. The Inland Marine policy from Farm Bureau Insurance provides coverage for all risks except those which are specifically. At Farm Bureau Insurance of Tennessee, we have policies that fit every need. Get a free auto insurance, home insurance, or life insurance quote and see why. Boats more than 40 years old aren't eligible for coverage. Geico Marine has been writing boat insurance since the s. Originally established as. We're giving away this sweeet TRAXXIS SPARTAN RC BOAT to one lucky winner!! Come see us at the St Charles Boat Show to get entered to win! Gregis Insurance Agency offers Farmers & Mechanics Home, Personal Auto, Mobile Home, Farm, and Business policies throughout WV. Call () Insuring Special Personal Property Farmers Mutual Insurance Co. All rights reserved. Technical Maintenance by Dynamic Business Solutions, Inc. Address Your Farm & Ranch Needs · Barns/Outbuildings – Class 1, 2, and Dairy Milking · Mobile Homes · Modular Homes · Inland Marine · Optional Coverages. Take a look at FMC's Farmers Market Insurance Business personal property/inland marine coverage is designed to respond to these instances vendors may face.

Online Algo Trading Course

Here are some highly recommended online courses for learning algorithmic trading and automated stock analysis using Python, ML and AI: . QuantConnect is a multi-asset algorithmic trading platform chosen by more than quants and engineers. Python algorithmic trading course with personalised support and hands-on learning. 20+ world-class faculty including Dr. Ernest Chan, Dr. Euan Sinclair. Algorithmic trading course as well as python algo trading course or executive program in algorithmic How to Become a Part of algo trading online classes by. These free online Algorithmic Trading courses will teach you everything you need to know about Algorithmic Trading. Build your subject-matter expertise. This course is part of the Trading Strategies in Emerging Markets Specialization Advance your career with an online. Join students in the algorithmic trading course that truly cares about you. Learn Practical Python for finance and trading for real world usage. Taught Online* This course teaches quantitative finance and algorithmic trading with an approach that emphasizes computation and application. A complete list of interactive algorithmic trading courses. Build algorithmic and quantitative trading strategies using Python. Start for free! Here are some highly recommended online courses for learning algorithmic trading and automated stock analysis using Python, ML and AI: . QuantConnect is a multi-asset algorithmic trading platform chosen by more than quants and engineers. Python algorithmic trading course with personalised support and hands-on learning. 20+ world-class faculty including Dr. Ernest Chan, Dr. Euan Sinclair. Algorithmic trading course as well as python algo trading course or executive program in algorithmic How to Become a Part of algo trading online classes by. These free online Algorithmic Trading courses will teach you everything you need to know about Algorithmic Trading. Build your subject-matter expertise. This course is part of the Trading Strategies in Emerging Markets Specialization Advance your career with an online. Join students in the algorithmic trading course that truly cares about you. Learn Practical Python for finance and trading for real world usage. Taught Online* This course teaches quantitative finance and algorithmic trading with an approach that emphasizes computation and application. A complete list of interactive algorithmic trading courses. Build algorithmic and quantitative trading strategies using Python. Start for free!

I am Petko Aleksandrov, the Head Mentor at Forex Academy, where we teach thousands of students daily with our online trading courses. In this algo trading. Algorithmic Trading Courses and Certifications ; Algorithmic Trading & Quantitative Analysis Using Python · ratings at Udemy · 22 hours 35 minutes. Algorithmic trading, a broad term for trading which uses mathematical models and algorithms, has become widespread and many markets are now dominated by high-. Learn algo trading IFMC offers the best Algorithmic trading course online in India. Explore short-term courses for beginners to help you trade in the live. This programme is for professionals working in the broader financial services industry, including investors, system traders, and quantitative analysts. TIAT offers online courses for programmers and non programmers to train and learn them into quantitative or algorithmic trading programmers. Welcome to our free Algorithmic Trading Course, we offer online hands-on video tutorials & support groups to help you build your own automated trading. What is a good course that can teach you the basics of algorithmic trading and quantitative finance? What online platform would you recommend. r/algotrading: A place for redditors to discuss quantitative trading, statistical methods, econometrics, programming, implementation, automated. Testimonials. “I had been looking for an online course on Algorithmic Trading by a reputable organization for years but none had the in-depth syllabus I was. Learn about the best algorithmic trading courses you can take online, based on professor reputation, skills taught, price, and more. This course teaches how to implement and automate your Trading Strategies with Python, powerful Broker APIs, and Amazon Web Services (AWS). Create your own. Learn how to successfully apply theoretical high frequency trading models in practice in the Oxford Algorithmic Trading online course. Algorithmic Trading. Overview Rules Notices Guidance News Releases Investor Education. As algorithmic trading strategies, including. What level of expertise should I expect to achieve from share market algo trading courses? On rugway-ie.ru we have online algo trading courses that take you. Learn cornerstone and advanced systematic trading methods, including recent advances in machine learning and AI. This course is both instructional and hands-on. 5 Best + Free Algorithmic Trading Courses Online [ September] · Oxford Algorithmic Trading Programme (University of Oxford) · Top Algorithmic Trading Courses. This course introduces students to the real world challenges of implementing machine learning based trading strategies including the algorithmic steps from. Masters in Algo Trading in India, Best Algo Trading Courses on Weekends with Flexible Schedule Post Graduate Program in Algorithmic Trading Course Online. The. FE Algorithmic Trading Strategies. If desired, the above courses can be applied to a full graduate degree from the School of Business, such as the master's.

What Is The Best Hedge Against Inflation

The stock market is a wonderful hedge against inflation for a few reasons. Since , the U.S. stock market is up % per year while inflation has averaged 3%. Simply put, an inflation hedge is an investment designed to protect your portfolio against a decrease in our currency's purchasing power, no matter where your. Traditionally, investments such as gold and real estate are preferred as a good hedge against inflation. However, some investors still prefer investing in. Self Storage Real Estate is a Great Inflation Hedge. While stocks, bonds, and cash lose their purchasing power as inflation rises, investing in self-storage. Gold is a proven long-term hedge against inflation but its performance in the short term is less convincing. Investments in gold and other precious metals have been a traditional method to hedge against inflation and times of economic distort. The value of gold and. There are several assets that have been an hedge against inflation, but over long periods of time. Some examples include: Gold, stocks, commodies, real estate. The most direct way to hedge against inflation it is to buy U.S. Treasury Inflation Protected Securities (TIPS), which will increase in value at. When limited only to financial assets, the energy equity sector provides the best potential inflation hedge, with positive inflation-adjusted return potential. The stock market is a wonderful hedge against inflation for a few reasons. Since , the U.S. stock market is up % per year while inflation has averaged 3%. Simply put, an inflation hedge is an investment designed to protect your portfolio against a decrease in our currency's purchasing power, no matter where your. Traditionally, investments such as gold and real estate are preferred as a good hedge against inflation. However, some investors still prefer investing in. Self Storage Real Estate is a Great Inflation Hedge. While stocks, bonds, and cash lose their purchasing power as inflation rises, investing in self-storage. Gold is a proven long-term hedge against inflation but its performance in the short term is less convincing. Investments in gold and other precious metals have been a traditional method to hedge against inflation and times of economic distort. The value of gold and. There are several assets that have been an hedge against inflation, but over long periods of time. Some examples include: Gold, stocks, commodies, real estate. The most direct way to hedge against inflation it is to buy U.S. Treasury Inflation Protected Securities (TIPS), which will increase in value at. When limited only to financial assets, the energy equity sector provides the best potential inflation hedge, with positive inflation-adjusted return potential.

There are six potential hedges against inflation: real estate, TIPS, commodities, stocks, gold, and bitcoin. Some work best for good inflation. Real estate is also a good hedge against inflation. and sometimes real estate inflation can even work to your advantage. Imagine there is a money supply of. Gold is the traditional inflationary hedge. Metal coin debasements resulted in inflation in Egypt from to BC and in China from to During these. This makes real estate one of the best hedges against inflation. This price appreciation means that exposure to the commodity market can be a good hedge. “TIPS are by far the best inflation hedge for the average investor,” she tells Select. TIPS bonds pay interest twice a year at a fixed rate, and they are. Many investors believe gold can be an excellent hedge against inflation, as it holds its value while currencies decrease in value. Hard assets can act as a hedge against inflation, helping you navigate through an uncertain economic landscape highest inflation rate since We saw a. Real estate is a well-known hedge against inflation. As the price of raw materials and labor goes up, new properties are more expensive to build. Which assets should I consider as inflation hedges? · Treasury inflation-protected securities (TIPS) · Series I savings bonds · Floating rate bonds · Commodities. When viewed through these lenses, farmland is arguably the absolute best hedge against inflation. In addition, farmland earns an annual income, which gold. According to historical data, stocks of companies that can raise prices for their products are actually the best hedges against inflation. They. Discover 12 inflation-resistant investments in , including fine wine, gold, and commodities. We'll also explore how Vinovest can help you hedge against. Many investors believe gold can be an excellent hedge against inflation, as it holds its value while currencies decrease in value. The top-performing asset class during the period was crude oil, but it would be a mistake to buy crude oil as an inflation hedge today. In the s, a. 2. Precious Metal Precious metals like gold and silver have high economic value and act as a great hedge against rising inflation. Gold has been readily used. The best hedge against inflation are income producing assets. Things like real estate or dividend stocks which provide consistent cash flow. Inflation Hedge - protect your retirement savings from high inflation by hedging your money against it with gold and silver, and other. Commercial real estate is a well-known inflationary hedge. During periods of inflation, investors turn to real property because it's a tangible asset with. The claim that real estate is a good hedge against inflation appears reasonable on theoretical grounds. All other things being equal, during periods of. Together with gold, other precious metals such as silver and platinum are also considered by some as good inflation hedge assets. Trade Gold CFDs with Admirals.

Cheap Insurance For Self Employed

You can apply for individual and family health insurance coverage through MNsure if you are a freelancer, consultant, independent contractor. Sole proprietors can now access affordable health insurance by joining a network of thousands of small businesses owners, employees and self-employed (). If you're self-employed or starting a solo business with little income: You'll probably qualify for low-cost insurance or free or low-cost coverage through. Depending on the plan, the insurance company will pay a certain amount of medical expenses and you and your employees will pay the rest. The Affordable Care Act. If you're self-employed or starting a solo business with little income: You'll probably qualify for low-cost insurance or free or low-cost coverage through. You may be eligible to enroll in an insurance plan through the Health Insurance Marketplace (also called the Affordable Care Act or Obamacare) if you're an. Best Bronze and Silver Pricing: Kaiser Permanente Kaiser offers affordable plans with excellent ratings. In many of the quotes we gathered, it had the lowest. If it is cheaper to file a claim, do that. Double-check for discounts. Earning a multi-policy discount won't save you a tremendous amount of. So how can you find cheap self employed business insurance? The cost How to find affordable self-employed business insurance. Here are a few tips to. You can apply for individual and family health insurance coverage through MNsure if you are a freelancer, consultant, independent contractor. Sole proprietors can now access affordable health insurance by joining a network of thousands of small businesses owners, employees and self-employed (). If you're self-employed or starting a solo business with little income: You'll probably qualify for low-cost insurance or free or low-cost coverage through. Depending on the plan, the insurance company will pay a certain amount of medical expenses and you and your employees will pay the rest. The Affordable Care Act. If you're self-employed or starting a solo business with little income: You'll probably qualify for low-cost insurance or free or low-cost coverage through. You may be eligible to enroll in an insurance plan through the Health Insurance Marketplace (also called the Affordable Care Act or Obamacare) if you're an. Best Bronze and Silver Pricing: Kaiser Permanente Kaiser offers affordable plans with excellent ratings. In many of the quotes we gathered, it had the lowest. If it is cheaper to file a claim, do that. Double-check for discounts. Earning a multi-policy discount won't save you a tremendous amount of. So how can you find cheap self employed business insurance? The cost How to find affordable self-employed business insurance. Here are a few tips to.

Affordable insurance. Licensed agents. No obligation quote. Customized coverage. Self-employed business insurance. Be your own boss, with back-up. Self-employed. Employee wages and fringe benefits; Property, liability or business interruption insurance; Interest (including mortgage interest paid to banks); Legal and. You'll also find out if you qualify for free or low-cost coverage through the Medicaid and CHIP programs in your state. This will depend on your income. Save money on your self-employed benefits. The Affordable Care Act now allows a self-employed health insurance deduction on premiums of %, meaning that. Some health insurance options for self-employed individuals are: Affordable Care Act (ACA) insurance policies, Medicaid, and Consolidated Omnibus Budget. Some health insurance options for self-employed individuals are: Affordable Care Act (ACA) insurance policies, Medicaid, and Consolidated Omnibus Budget. "When you're self-employed, finding affordable health insurance isn't easy. cheap. If you're unfortunate enough to use the services then you have. General liability insurance is the first type of insurance most self-employed business owners get. Often called slip and fall insurance, general liability. self-employed health insurance Request a Health Quote Today for NASE's affordable health insurance options, and learn more about the new health care law. insurance coverage, and for many people, it's also the cheapest. Both of these changes make it easier to find affordable health insurance if you're self-. My wife and I both are self employed. Our premiums run $/mo with a $7K ($/ea.) deductible and $13K max out of pocket for a PPO plan. Self-Employed People. A health plan through Covered California is a great option low-cost coverage through Medi-Cal. no-cost or low-cost coverage. Find affordable health insurance Compare available plans and get recommendations. Fidelity does not provide legal or tax advice. The information herein is. Recently self employed and lost insurance. I tried the ny health insurance cheap plans or expensive high coverage plans. Upvote 3. Downvote. Top Options to Get Self-Employed Insurance for Freelancers · 1. Spouse's Policy · 2. COBRA · 3. Affordable Care Act · 4. Local chamber or business group · 5. So how can you find cheap self employed business insurance? The cost How to find affordable self-employed business insurance. Here are a few tips to. Instant online quotes on Colorado Small Business Health Insurance. Best available rates. Free Quotes. Low Cost Colorado Health Insurance and Major Medical. Premier is a leading provider of affordable health insurance for self-employed individuals in Illinois, learn more from our Lisle IL health insurance. The search for affordable insurance is something that most self-employed people experience at some point. The cost of self-employed commercial insurance. Is it tax deductible? Commercial coverage; Coverage amounts; Get cheap coverage; FAQs. Table of contents. Cheapest rates.

How To Trade Oil

It is highly demanded, traded in volume, and extremely liquid. Oil trading therefore involves tight spreads, clear chart patterns, and high volatility. Crude Oil increased USD/BBL or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark. Investors and traders can use crude oil futures to speculate on the future price of crude oil and might be used as an alternative to oil and gas stocks. With Traders Trust you can trade CFDs on Brent Crude (UK Oil) and WTI (US Oil) crude oil. You can open long (buy) or short (sell) positions. In this guide, we aim to demystify the basics of crude oil trading and unveil the most effective crude oil intraday trading strategy in India to empower. Since , Crude Oil has been traded on the electronic Intercontinental Exchange, known as ICE. One contract is equal to barrels and is quoted in USD. In. Learn more about US crude oil trading – from how the market works and what drives the prices, to different types of instruments and trading strategies. If you want to learn how to do commodity trading in oil or crude oil futures trading, this beginner's guide is the right place to start. You'll choose between a call or a put option to get exposure to oil. A call option grants you the right, but not the obligation, to buy or sell the underlying. It is highly demanded, traded in volume, and extremely liquid. Oil trading therefore involves tight spreads, clear chart patterns, and high volatility. Crude Oil increased USD/BBL or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark. Investors and traders can use crude oil futures to speculate on the future price of crude oil and might be used as an alternative to oil and gas stocks. With Traders Trust you can trade CFDs on Brent Crude (UK Oil) and WTI (US Oil) crude oil. You can open long (buy) or short (sell) positions. In this guide, we aim to demystify the basics of crude oil trading and unveil the most effective crude oil intraday trading strategy in India to empower. Since , Crude Oil has been traded on the electronic Intercontinental Exchange, known as ICE. One contract is equal to barrels and is quoted in USD. In. Learn more about US crude oil trading – from how the market works and what drives the prices, to different types of instruments and trading strategies. If you want to learn how to do commodity trading in oil or crude oil futures trading, this beginner's guide is the right place to start. You'll choose between a call or a put option to get exposure to oil. A call option grants you the right, but not the obligation, to buy or sell the underlying.

Oil and gas trades are dominated by three major markets in London, New York, and Singapore. These are well-established centers where many active buyers and. Oil trading is the process of buying or selling oil while trying to earn a profit. Oil is one of the most widely traded commodities in the world. Access the World's Most Popular Oil Contract at A Fraction of the Cost. At 1/10th the size of the standard crude oil contract, Micro crude oil futures (MCL). In this article, we'll explore the key steps to conducting solid fundamental analysis supported by the most commonly used technical analyses when trading the. Oil trading involves buying and selling oil contracts with the goal of profiting from price fluctuations. Oil-storage trade The oil-storage trade, also referred to as contango, is a market strategy in which large, often vertically-integrated oil companies purchase. We supply and market crude oil and refining products. We take care of maritime transport and the management of product coverage in the financial derivatives. The best way to get into oil trading is to hire into an entry level position with a company that deals in physical oil transactions. Spend years. Oil futures CFDs are traded on Plus's trading app 23 hours a day, 5 days a week, based on price quotes provided by the New York Mercantile Exchange – a. We'll provide you with a simple strategy in this blog post. We will also give you a FREE robot, so you can trade oil automatically right from your own account. WTI Crude Oil futures and options are the most efficient way to trade the largest light, sweet crude oil blend. There are three main ways to trade oil: the oil spot price, oil futures or oil options. With FXTM, you can use CFDs to speculate on oil spot prices. Oil futures, oil-linked stocks and funds make it more accessible for beginners to trade and invest in petroleum-related products — without having to relocate. To start investing in the oil market, all you need to do is open an investment account. The process of opening an account with XTB takes place completely online. Trade Brent crude oil sport CFDs, other major commodities, indices, forex and shares through rugway-ie.ru's award-winning platform. Available on web and mobile. If you are beginning to consider trading crude oil for the first time, you should start by understanding what factors drive this limited resource. For instance, if you want to trade in Rs 50 lakh worth, you only have to deposit Rs lakh in margins. Plus, the crude oil market is also very liquid (in. Crude oil, also known as petroleum, is a liquid found in the Earth and it is made of hydrocarbons, organic compounds, and tiny amounts of metal. Any strategy for trading crude oil will begin with a fundamental analysis of the market to understand the current, underlying supply and demand dynamics of the. Another major benefit of trading crude oil futures is the leverage it provides as well as efficient use of capital. As mentioned above, the current price of a.

Investing In Google Stock

Google Finance provides real-time market quotes, international exchanges, up-to-date financial news, and analytics to trading and investment decisions. Get the latest Alphabet Inc. (GOOG) stock news and headlines to help you in your trading and investing decisions. The stock remains a safe investment due to the dominance of its search business and massive cash holdings. Invest in Alphabet (Class A), NASDAQ: GOOGL Stock - View real-time GOOGL price charts Own even the most expensive stocks like Google, Amazon and Apple. Benzinga. Google Parent Company In Bear Territory, Down 35% From Highs: Should Investors Be Eyeing Alphabet Comeback? 10 hours ago ; Yahoo Finance. Is Trending. Google's cloud computing platform, or GCP, accounts for roughly 10% of Alphabet's revenue with the firm's investments in up-and-coming technologies such as self. Create a portfolio Custom portfolios let you manage and track your personal investment value over time. Go to rugway-ie.ru On the right, click New. GOOGL shares are its Class-A shares, which give investors an ownership stake as well as voting rights. In , Alphabet's share price stood as one of the eight. GOOG vs. GOOGL: Which Is a Better Investment? Because GOOGL shares come with voting rights, they may be considered more valuable. Shareholders with this type. Google Finance provides real-time market quotes, international exchanges, up-to-date financial news, and analytics to trading and investment decisions. Get the latest Alphabet Inc. (GOOG) stock news and headlines to help you in your trading and investing decisions. The stock remains a safe investment due to the dominance of its search business and massive cash holdings. Invest in Alphabet (Class A), NASDAQ: GOOGL Stock - View real-time GOOGL price charts Own even the most expensive stocks like Google, Amazon and Apple. Benzinga. Google Parent Company In Bear Territory, Down 35% From Highs: Should Investors Be Eyeing Alphabet Comeback? 10 hours ago ; Yahoo Finance. Is Trending. Google's cloud computing platform, or GCP, accounts for roughly 10% of Alphabet's revenue with the firm's investments in up-and-coming technologies such as self. Create a portfolio Custom portfolios let you manage and track your personal investment value over time. Go to rugway-ie.ru On the right, click New. GOOGL shares are its Class-A shares, which give investors an ownership stake as well as voting rights. In , Alphabet's share price stood as one of the eight. GOOG vs. GOOGL: Which Is a Better Investment? Because GOOGL shares come with voting rights, they may be considered more valuable. Shareholders with this type.

Alphabet (NASDAQ: GOOGL) ; NASDAQ: NFLX. Netflix. Netflix Stock Quote ; NYSE: DIS. Walt Disney. Walt Disney Stock Quote ; NASDAQ: GOOG. Alphabet. Alphabet Stock. $7 billion in assets under management. Resources to help you grow, with typical investments of $ million per company · 16 IPOs and 9 M&A exits. Laser. (NASDAQ: GOOGL) Google currently has 12,,, outstanding shares. With Google stock trading at $ per share, the total value of Google stock (market. Join the competition now and prove your investing prowess! The Stock Market Allow teams to look up ticker symbols and enter trades. Google Play · AppStore. Google's dominance in search provides a consistent revenue stream from advertising. · The company continues to invest in growing technologies like cloud. Investing Quizzes. Featured Information. Star icon. New Public Service Taking Stock in Teen Trading. Learn how to form a saving and investing parent. Alphabet Inc (Class A) Google Shares (GOOGL) share price as of September 13, , is $ If you are investing from India, you can always check the. GOOG | Complete Alphabet Inc. Cl C stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. Access real-time $Alphabet stock insights on eToro. ➤ View prices, charts, and analyst price target ✓ Invest in GOOG Now. Peter Lynch is one of the most legendary investors/fund managers of all time. His philosophy for stock investing is very simple and straightforward: he invests. Our finance app offers real-time data on major indices like the Dow Jones and provides a stock tracker for keeping track of penny stocks. Learn how to buy Google stock, understand stock splits, and explore the stock forecast. Discover the appeal of investing in Google, its history, risks. Alphabet Inc. is a holding company. The Company's segments include Google Services, Google Cloud, and Other Bets. (NASDAQ: GOOGL) Google currently has 12,,, outstanding shares. With Google stock trading at $ per share, the total value of Google stock (market. Discover real-time Alphabet Inc. Class A Common Stock (GOOGL) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Alphabet Inc. will replace Google Inc. as the publicly-traded entity and all shares of Google Investing at the scale of the opportunities and resources we see. Get real-time stock alerts and breaking news to track volatile markets now! More by rugway-ie.ru Is Alphabet stock a Buy, Sell or Hold? Alphabet stock has received a consensus The History of Google's Stock Price by Markets Insider. Google is a. Shares in Response to the Mini-Tender Offer By Tutanota LLC. June 5, Anat Ashkenazi to Join Google and Alphabet as Chief Financial Officer. April View Alphabet Inc. Class C GOOG stock quote prices, financial information Latest investing news. Former US President and Republican presidential.

Can You Buy Shares From A Private Company

With this said, private company stocks include the shares issued by private companies to their investors, executives and employees. For instance, startups. If you are buying the company through share purchase, it is likely that you will be buying all the existing shares of the company. This will grant you full. Confidentiality is imperative when trading private shares to protect the privacy of the company and its shareholders. William Blair has strict confidentiality. You might think that you can buy them out later, but in reality, this is unlikely. As your company's value increases, you may find you cannot buy out that. A privately held company is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in their. You can also become a registered shareholder by buying stock directly through Computershare online using our Investor Center. Company share structure. If you have to ask, no. Unless there's an active secondary market to sell (most private companies require board approval to sell, which you won'. This Insider Trading Policy (this “Policy”) summarizes the insider trading rules and explains how Insiders can buy or sell stock so that they are in compliance. If you own shares of stock in a privately held company, your options for selling the are limited. You can sell them back to the company, to an accredited. With this said, private company stocks include the shares issued by private companies to their investors, executives and employees. For instance, startups. If you are buying the company through share purchase, it is likely that you will be buying all the existing shares of the company. This will grant you full. Confidentiality is imperative when trading private shares to protect the privacy of the company and its shareholders. William Blair has strict confidentiality. You might think that you can buy them out later, but in reality, this is unlikely. As your company's value increases, you may find you cannot buy out that. A privately held company is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in their. You can also become a registered shareholder by buying stock directly through Computershare online using our Investor Center. Company share structure. If you have to ask, no. Unless there's an active secondary market to sell (most private companies require board approval to sell, which you won'. This Insider Trading Policy (this “Policy”) summarizes the insider trading rules and explains how Insiders can buy or sell stock so that they are in compliance. If you own shares of stock in a privately held company, your options for selling the are limited. You can sell them back to the company, to an accredited.

You can sell shares in a private company through a buyback program, by locating an investor to purchase the shares or through online exchanges like Forge. They'll have to pay income tax on any dividends from the business, and the amount of tax they'll owe will be determined by how much other income they earn. How. Private companies often decide to purchase their own shares from shareholders. A common situation is when an existing shareholder wants to sell some or all. Essentially, by being publicly traded, companies make it easier for investors to buy and sell shares of the company. This can offer early investors the. To invest in a private limited company, the investor will generally need to purchase at least one share for an agreed sum. The type of shares offered is. An effective tool for owners of private companies, to attract and retain talented employees, is to offer them an ownership interest in the company. Can I purchase stock directly from Apple? No, but Apple stock can be purchased through just about any brokerage firm, including online brokerage services. But, did you know that selling shares of private companies is possible? In this article, we will discuss ways to sell shares of a private company. Stock selling. There are different types of ownership. In the case of owning shares, you are one owner among many, so you are beholden to the board of. You do not have to pay tax if you: are given shares for nothing; subscribe to a new issue of shares in a company; buy shares in an 'open ended investment. On the other hand, shares in a private company do not even need to be bought. Shares can be gifted to individuals by existing shareholders. For example, you. Some companies may allow for the sale of private companies shares while some may not. Even if your plan is allowed to do so, it may not be as simple as trading. As a private company shareholder, the market enables you to sell your private shares regardless of whether the business has raised investment on Seedrs before. Furthermore, because private equity firms buy only to sell, they are not seduced by the often alluring possibility of finding ways to share costs, capabilities. Additionally, shareholders are typically bound by strict agreements that impose restrictions about who can buy and sell shares and under what conditions. The share purchase in a private company, however, involves the shares in the company being transferred from the seller to the purchaser. Join the all-in-one platform empowering private capital markets. Free forever, Kore makes it easy for participants in private capital markets to manage their. Individuals are prohibited from trading GDRs in accordance with Rule A of the US Securities Exchange Act. Shares on the KRX. Method I. Foreign investors can. As a shareholder, you can decide at any time to sell all or some of your shares to other investors. You can sell them – or buy them – at a stock exchange if. Company may buy its own shares in certain circumstances · that acquiring the shares is in the company's best interests · that the terms of the offer and the.

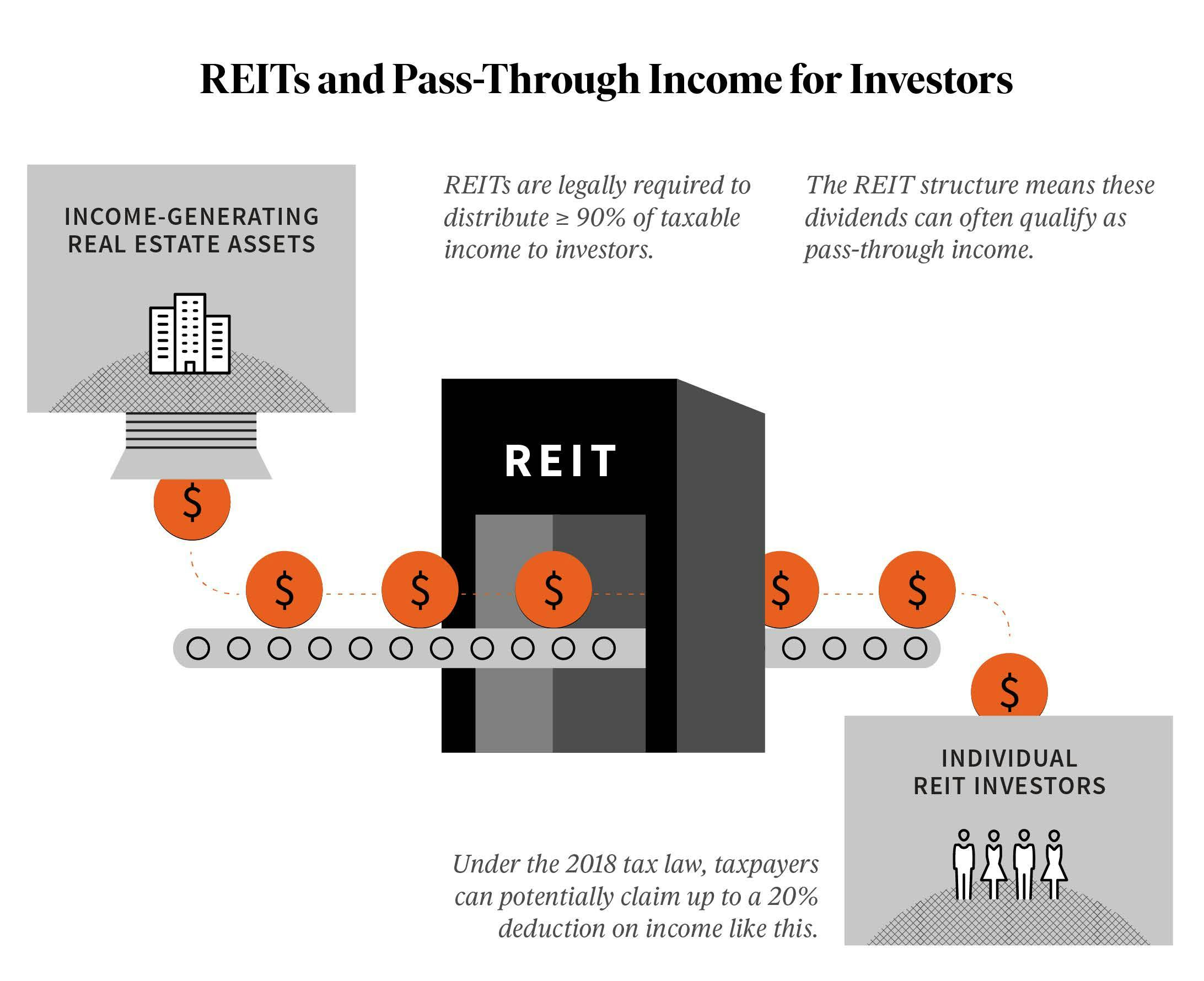

How Much Is A Reit

When you buy a REIT, you are basically buying stock in a company that specializes in real estate. They pay a relatively high dividend because. A REIT is a company that owns, operates, or finances income-producing real estate. Income from a REIT can come in the form of regular dividends, which makes. As of August 30, , REIT stock price climbed to $ with 3, million shares trading. How much is Alps Active REIT ETF worth? REIT has a market cap of. Listed REITs · What is REIT? · How REIT Works? · Why REIT? · Important terminologies · Key Performance Indicators · REIT V/s Real Estate · Taxation. By investing in REITs, you can get a steady income, reduce your investment risk, and make money as the properties increase in value over time. Equity REITs. While a 90% annual dividend payout is required by law and IRS regulation, different REITs pay on different schedules within that requirement. How often are REIT. The maximum capital gains tax rate of 20% (plus the % Medicare Surtax) applies generally to the sale of REIT stock. How do shareholders treat REIT dividends. Since the companies are mostly tax exempt and are obligated to pay out the vast majority of their earnings in dividends, REIT yields are typically much. There's only one catch: the payouts are not generated from the company's earnings. This largely explains why so many REITs have low payout ratios. In equity. When you buy a REIT, you are basically buying stock in a company that specializes in real estate. They pay a relatively high dividend because. A REIT is a company that owns, operates, or finances income-producing real estate. Income from a REIT can come in the form of regular dividends, which makes. As of August 30, , REIT stock price climbed to $ with 3, million shares trading. How much is Alps Active REIT ETF worth? REIT has a market cap of. Listed REITs · What is REIT? · How REIT Works? · Why REIT? · Important terminologies · Key Performance Indicators · REIT V/s Real Estate · Taxation. By investing in REITs, you can get a steady income, reduce your investment risk, and make money as the properties increase in value over time. Equity REITs. While a 90% annual dividend payout is required by law and IRS regulation, different REITs pay on different schedules within that requirement. How often are REIT. The maximum capital gains tax rate of 20% (plus the % Medicare Surtax) applies generally to the sale of REIT stock. How do shareholders treat REIT dividends. Since the companies are mostly tax exempt and are obligated to pay out the vast majority of their earnings in dividends, REIT yields are typically much. There's only one catch: the payouts are not generated from the company's earnings. This largely explains why so many REITs have low payout ratios. In equity.

That strong demand coupled with healthy balance sheets for many of the landlords who own these properties may make investing in real estate investment trusts . How Does a REIT Work? REITs can invest in all property types, although most specialize in specific property types. There are around US public REITs with a. A REIT's dividend yield is only attractive, however, if it is sustainable and, preferably, able to be increased over time. This chapter discusses how to. They typically feature limited liquidity. NAV REITs NAV REITs regularly disclose the net asset value (NAV) of its shares, conduct offerings of its stock at. How Many REITs Are There in the World? A total of listed REITs with a combined equity market capitalization of approximately $ trillion (as of December. How do REITs pay dividends? REITs are required to distribute at least 90% of income to investors through dividends and any portion of income distributed to. The P/B value is a financial ratio that shows investors how much the REIT's shareholders are paying for the net assets of the REIT compared to the REITs market. How Much Gain Would a REIT Defer if a REIT Could Defer Gain? Key REIT Conversion Considerations · REIT Conversion Work Streams · U.S. REITs Investing Globally. These fees are run roughly 20–30% of the value of the REIT. This takes a sizable chunk out of your potential returns. And because REIT prices are set in the. Steady dividend income and capital appreciation: Investing in REITs is said to provide substantial dividend income and also allows steady capital appreciation. How do REITs work? Once a fund successfully qualifies as a REIT, investors can buy shares in a variety of ways. The REIT pools this capitalization to make. How do REITs work? Once a fund successfully qualifies as a REIT, investors can buy shares in a variety of ways. The REIT pools this capitalization to make. The legal details seem to adopt much of the British REIT regulation. A law concerning REITs was enacted 1 June , effective retroactively to 1 January. Many investors invest in REITs for their high yields. Since the companies are mostly tax exempt and are obligated to pay out the vast majority of their earnings. These fees can reach as high as 15% of the offering price, which lowers the value and returns on your investment because it leaves less money for the REIT to. How does a REIT with rental properties work? As previously stated, a REIT works a lot like a stock investment. The first step is purchasing shares of the REIT. The P/B value is a financial ratio that shows investors how much the REIT's shareholders are paying for the net assets of the REIT compared to the REITs market. REITs are required to distribute 90% of taxable income. Typically, REIT distributions are taxed at ordinary income rates which can be as high as 37%. The. Investors have many ways to invest in REITs. The easiest is to buy shares of publicly traded REITs through a brokerage account. An investor could purchase a. Even though I make so much more money investing in single family rental properties, that type of investing may not be for everyone. Actually, investing in.

How To Remove Negative Items From Credit Report For Free

A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more. So if you see companies offering to remove accurately reported late payments and other negative information from your credit reports, don't buy it. Say you made. You can dispute the item with the credit bureaus, and/or creditors or debt collectors, and they'll make a decision as to whether to remove it. Removing negative items from your credit report requires patience, persistence, and a proactive approach. While it may not be possible to remove all negative. How to Request Your Credit Reports · By telephone: Call toll-free: · Online: rugway-ie.ru Your better option is to draft a dispute letter and mail it directly to the credit bureau as well as to the creditor that furnished the information. File a. By law, you are allowed to dispute inaccurate information on your credit report, and there is no fee for filing a dispute. You may submit your dispute to the. Dispute information on your Equifax credit report File or check on the status of a dispute for free. SUBMIT A DISPUTE CHECK A STATUS. When does filing a. Strategies to Remove Negative Credit Report Entries · Submit a Dispute · Dispute With the Business · Send a Pay for Delete Offer · A Goodwill Request for Deletion. A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more. So if you see companies offering to remove accurately reported late payments and other negative information from your credit reports, don't buy it. Say you made. You can dispute the item with the credit bureaus, and/or creditors or debt collectors, and they'll make a decision as to whether to remove it. Removing negative items from your credit report requires patience, persistence, and a proactive approach. While it may not be possible to remove all negative. How to Request Your Credit Reports · By telephone: Call toll-free: · Online: rugway-ie.ru Your better option is to draft a dispute letter and mail it directly to the credit bureau as well as to the creditor that furnished the information. File a. By law, you are allowed to dispute inaccurate information on your credit report, and there is no fee for filing a dispute. You may submit your dispute to the. Dispute information on your Equifax credit report File or check on the status of a dispute for free. SUBMIT A DISPUTE CHECK A STATUS. When does filing a. Strategies to Remove Negative Credit Report Entries · Submit a Dispute · Dispute With the Business · Send a Pay for Delete Offer · A Goodwill Request for Deletion.

Thanks to the FCRA, you can also dispute collections (or other credit items) that contain errors like incorrect balances, wrong dates and other types of invalid. You should start the dispute directly with the credit bureau that has the inaccurate information, and this can be done online or via mail. If the dispute. Online: The most convenient way to request your free credit reports is through the official website rugway-ie.ru The three major credit bureaus. If it can't be verified, then it must be removed. If that happens, the credit bureau will provide a free copy of your report so you can confirm the item no. The time to ask for it to be removed was before you paid it. You could negotiate payment based on removing the reference. Your only recourse now. Annual Credit Report Request Service, P.O. Box , Atlanta, Georgia, Your report will be mailed to you within fifteen days. Some companies offer. If a negative item in your credit report is not accurate, you can dispute it. You inform the credit bureau of the error, by letter or online. The credit bureau. Yes, it is possible for someone to fix their credit and remove negative items from their credit report with the help of credit repair expert. Under federal law, consumers can receive one free copy of your credit report every 12 months from each of the three credit reporting agencies (Equifax, Experian. Federal law allows you to dispute inaccurate information on your credit report. There is no fee for filing a dispute. You can dispute the item with the credit bureaus, and/or creditors or debt collectors, and they'll make a decision as to whether to remove it. You start your cost-free DIY odyssey by ordering a free credit report from rugway-ie.ru This source is authorized by the federal government to give. Pay for delete is an agreement with a creditor to pay all or part of an outstanding balance in exchange for that creditor removing negative information from. In many states, you will be eligible to receive a free credit report directly from the credit bureau, once a dispute has been registered, to verify the updated. If you come across negative items that you believe are inaccurate or outdated, you have the right to dispute them. Credit bureaus must. Dispute it. Disputing mistakes or outdated things on your credit report is free. Both the credit bureau and the business that supplied the information about you. If there is incorrect information in your credit report, you may ask the credit reporting agency to investigate. For most items, you must do so in writing and. Here's how: The three major credit reporting bureaus (Experian, Equifax, and TransUnion) produce credit reports. Ask the collector to tell the bureaus to remove. How to Remove ALL Negative Items from your Credit Report: Do It Yourself Guide to Dramatically Increase Your Credit Rating [Roash, Riki] on rugway-ie.ru Disputes are an important tool to take control of your credit health. Managing your information is fast, easy, free and secure through the TransUnion Service.